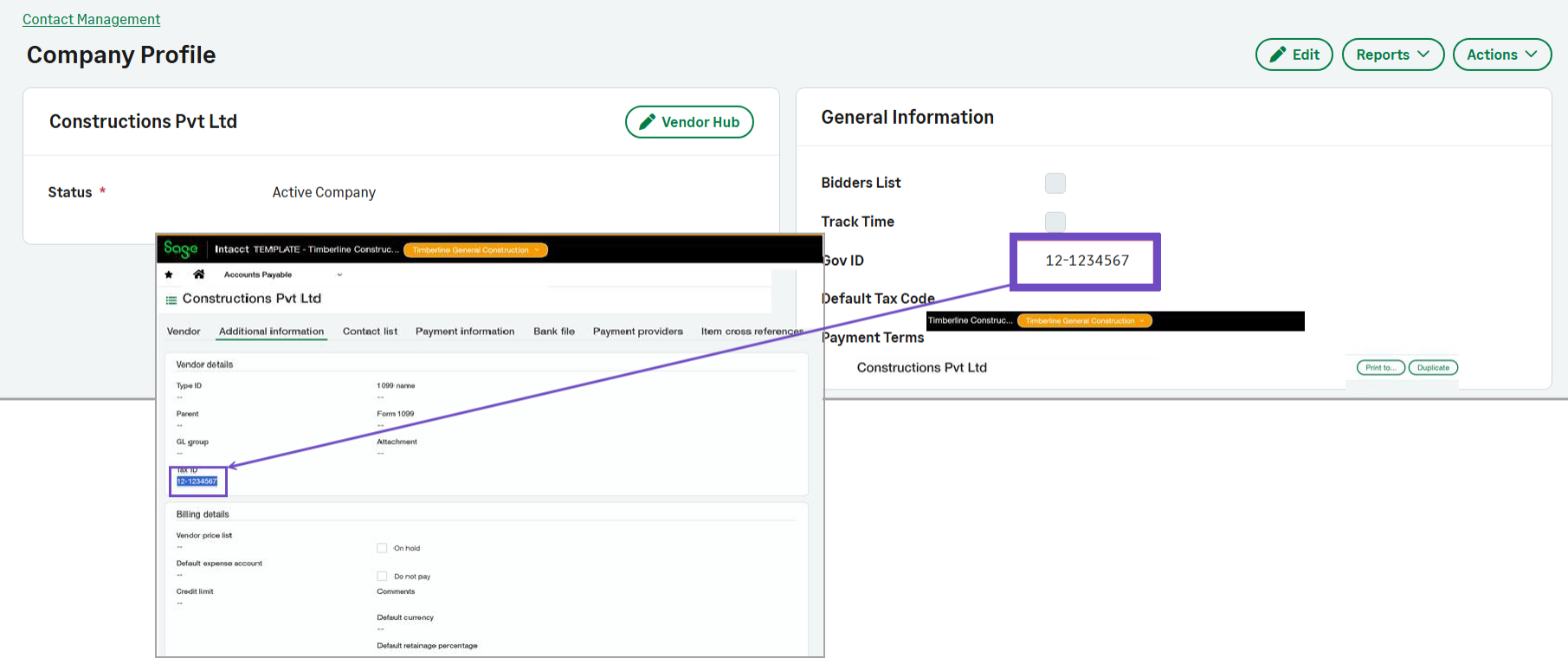

Validate tax IDs posted to Sage Intacct

Sage Construction Management now validates the format of vendor tax IDs sent to Sage Intacct to ensure that vendor tax IDs are successfully posted.

Details

When posting tax IDs to Sage Intacct, Sage Construction Management validates the tax IDs to ensure that their format is accepted by Sage Intacct.

Sage Intacct accepts tax IDs that include alphanumeric characters in the following formats:

-

XXX-XX-XXXX

-

XX-XXXXXXX

If the tax ID does not match any of the above formats, a blank value will be posted.

How it works

-

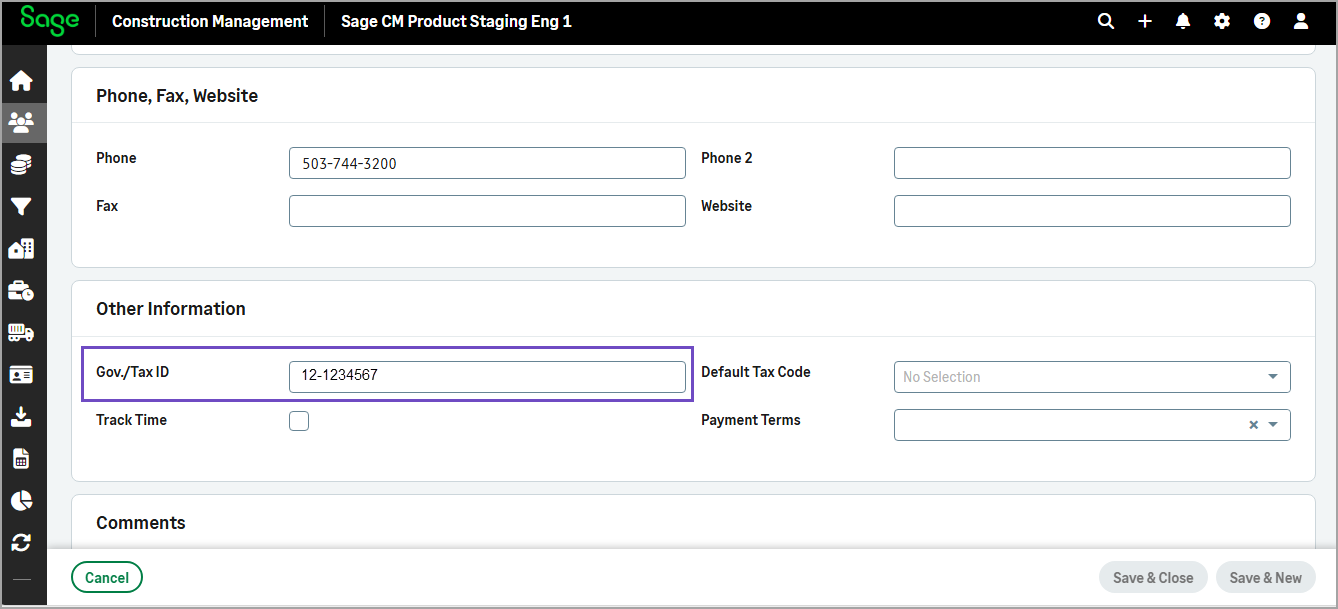

Select Contact Management > Companies.

-

Select the required company and edit its Gov./TaxID to be in one of the following formats, which currently apply to US Tax Ids:

-

XXX-XX-XXXX

-

XX-XXXXXXX

Where is X is alphanumeric.

-

-

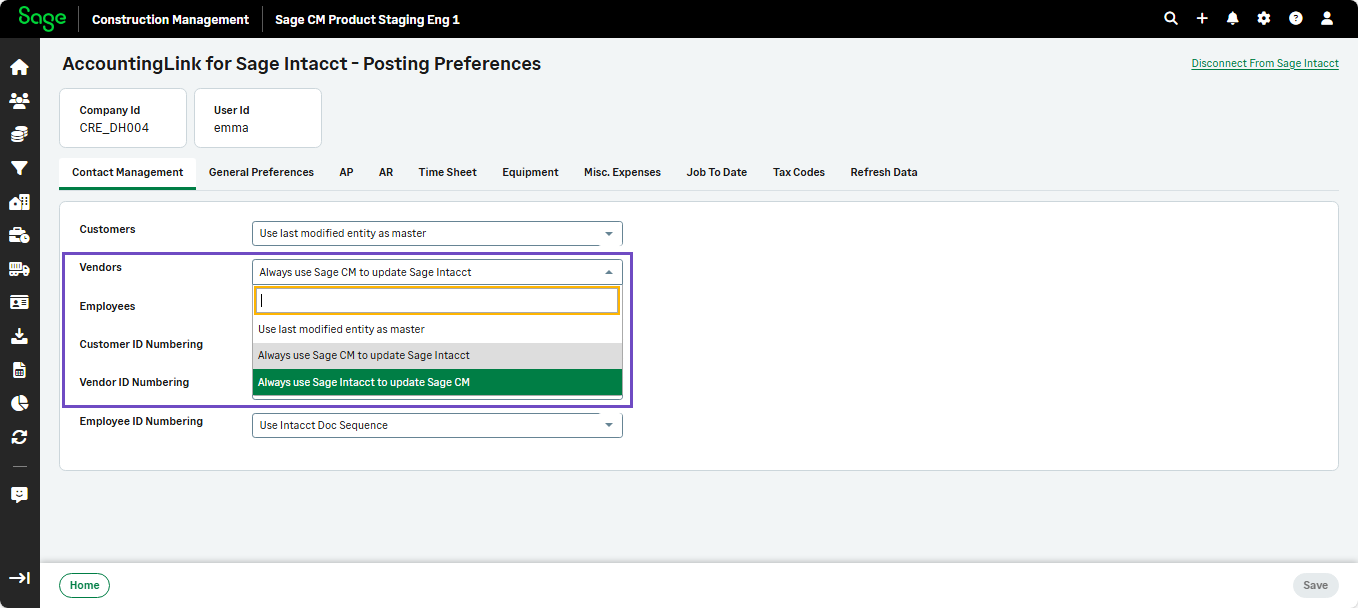

Go to AccountingLink > Posting Preferences > Contact Management.

-

Select Always use Sage Intacct to update Sage CM from the Vendors dropdown.

-

Go to the AccountingLink > Contact Management > Sync Linked Vendors to post the vendor details to Sage Intacct.

Check Sage Intacct to confirm the Vendor Tax Id has been successfully posted.